We uncover the new drivers of inflation post covid

Inflation in 2021 has reached levels unseen since 1982 with annual rates as high as 7% in the US or 5% in the euro area. As it eats up purchasing power at a fast pace, one of the hottest questions in early 2022 is: how long will it last? To be able to answer this question, one needs to understand what drives inflation dynamics. Economic theory provides different answers, going from a simple monetary phenomenon to demand pressures outpacing the potential output. However, monetarism-enthusiasts, as well as true-Keynesians, will still need to forecast it accurately because of its large impacts on the entire economy.

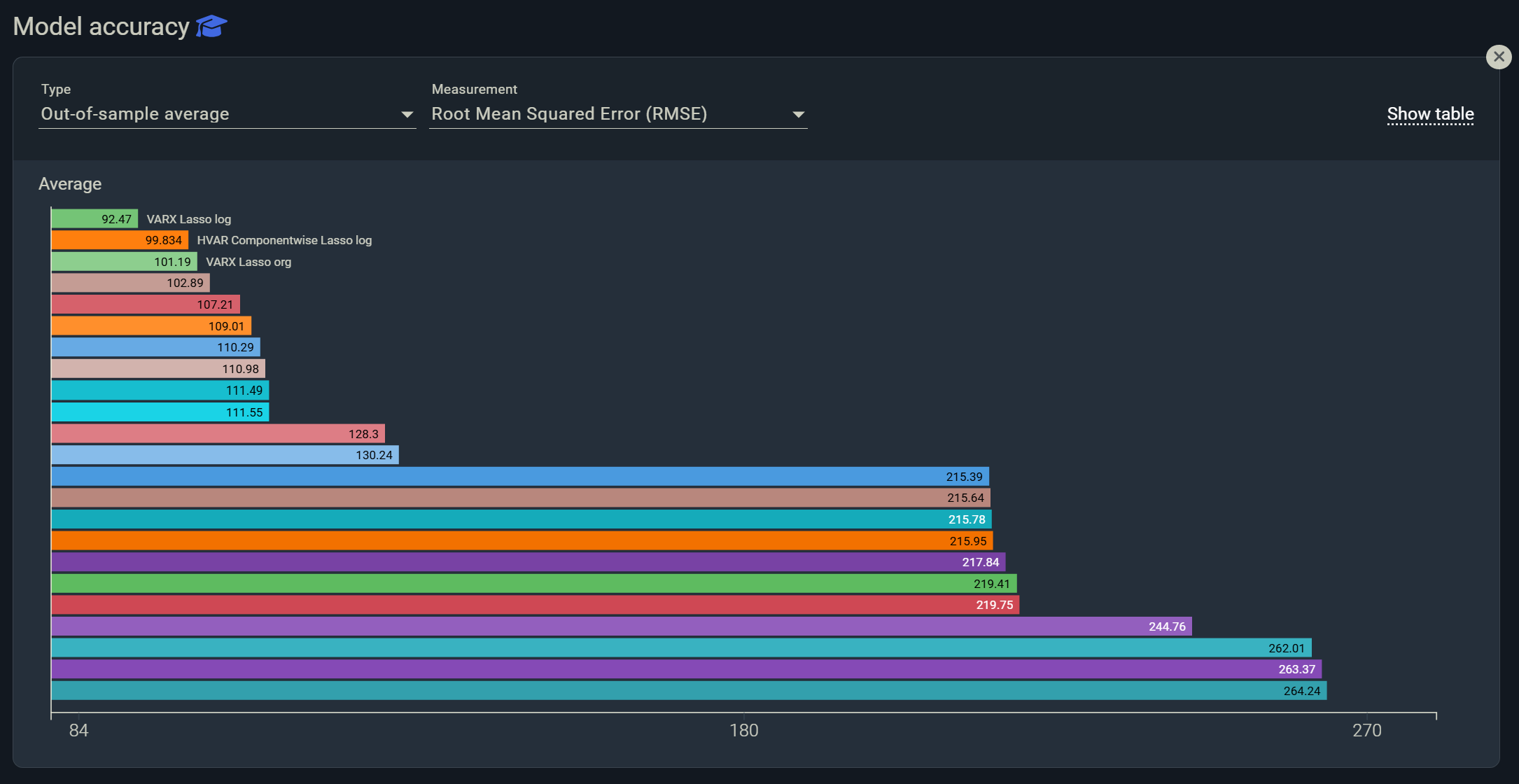

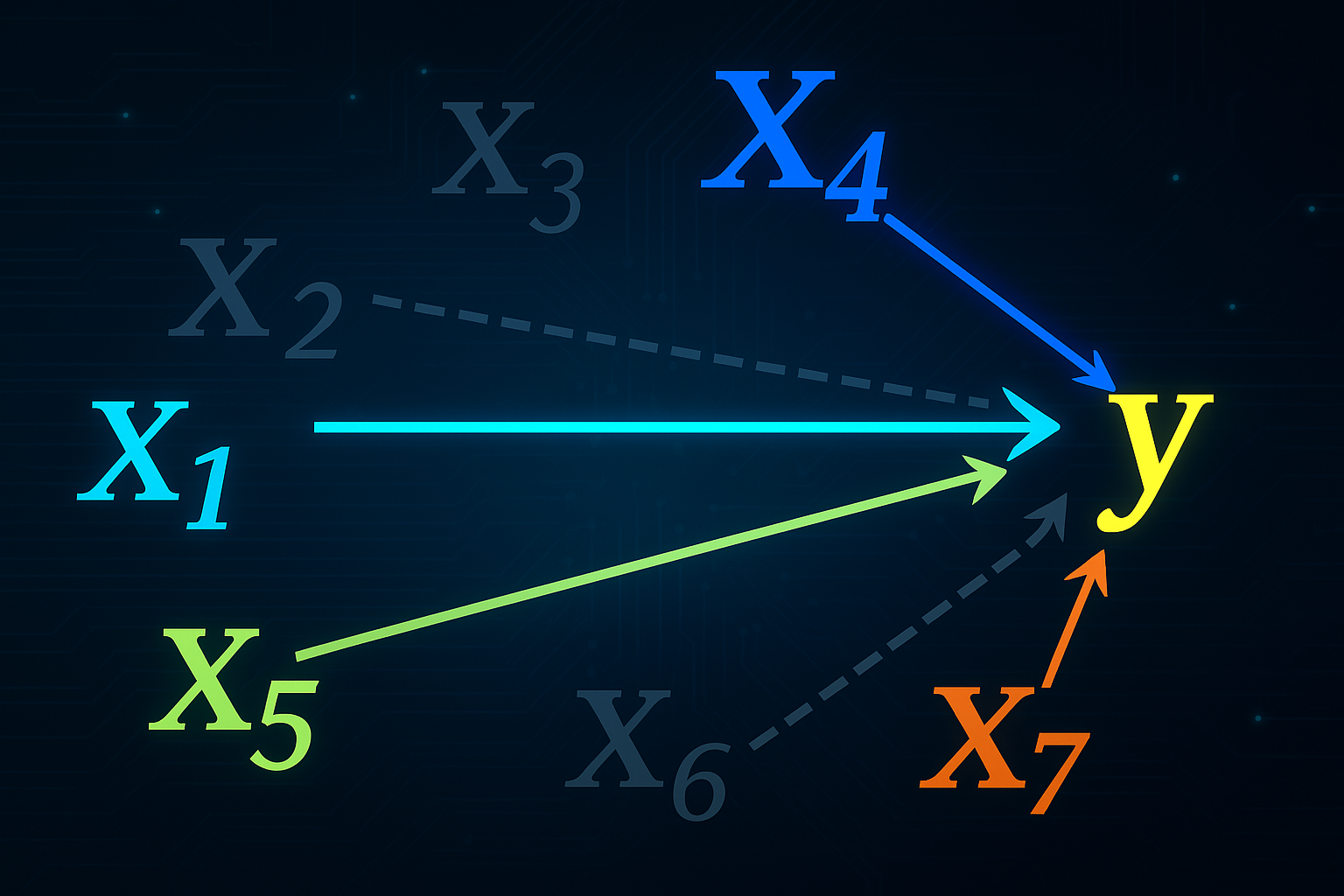

At Indicio, rather than just from theories, we opt for a data-driven approach to identify inflation drivers. Our indicator analysis tool, combining the best from econometrics and machine learning literature, only selects indicators that improve forecast performance. This way, one only keeps relevant information, in order to better understand the true causes of inflation.

Inflation, now fueled by very different factors, makes for an interesting experiment to test whether the data-driven approach can detect and understand the indicators shift that occurred during the pandemic.

We ran the model on CPI data in the US on two periods: 2001-2020 and 2001-2022, with these 14 indicators:

- US GDP

- M2

- Unemployment Rate

- Cleveland Federal Reserve 1-year inflation expectation

- Global Supply Chain Pressure Index

- Crude Oil Price

- Debt/GDP Ratio

- Wages & Salaries, All Industries, Net Increase Index (NRI)

- Industries Supplies and Materials excluding fuels

- Federal Funds Effective Rate

- Personal Consumption Expenditures

- Average electricity per kWh

- Personal Income

- Government spending

Inflation followed a stable 2.21% average increase over the past 20 years and Indicio selected classic drivers over the period, with aggregate demand variables as a steady fuel. The pandemic era displays similar variables but their importance varies. The inflation that we currently observe is mainly caused by a soaring demand and hindered supply. The economic boom that followed the quick recession, as well as the increase in the money supply since 2020, have driven aggregate demand up, leaving prices as the only adjustment in an overheating economic environment.

"Our indicator analysis tool measures variable importance over time to target and enhance meaningful dynamics for better forecasting performance."

Indicio’s data-driven approach captures this phenomenon by ranking M2 and government spending highest in the post-pandemic forecast. This is also confirmed by the higher place given to personal consumption expenditure and GDP. M2 increased by 30% between 2020 and 2021, a pace that had never been seen before, as a result of Fed and Congress actions.

We compare the pre-covid figures ...

vs the post-covid figures...

Our indicator analysis tool measures variable importance over time to target and enhance meaningful dynamics for better forecasting performance. The Fed announced 7.5% YOY inflation in January 2022, more than what forecasts suggested and the highest since 1982.

Contact us if you'd like to forecast inflation & other macro-variables accurately.